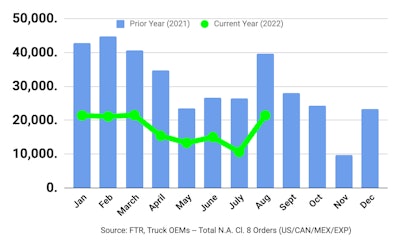

FTR reported Tuesday preliminary North American Class 8 net orders jumped an impressive 98 percent month over month in August to 21,400 units. ACT Research tracked the month at 21,600 units in its August release yesterday.

FTR attributes the sudden bump to OEMs who began placing a limited number of orders for the first quarter of 2023 and states it appears the truck makers “have returned to the pattern of the first quarter of this year when orders averaged 21,100 units.”

The company expects orders will continue to rise next month as additional orders are booked for Q1 deliveries. Despite the large sequential jump, August orders were still down 46 percent year over year.

“The good news is the traditional summer order slump has ended a month early this year. OEMs felt the need to start filling in their Q1 production schedules for their prime customers. The supply chain is still cogged so they still are unable to book all the commitments they still have,” says Don Ake, vice president of commercial vehicles, FTR.

“It is interesting that August order totals are so close to the January-March numbers earlier this year. Just like then, OEMs must be careful not to overbook, with the supply chain still not showing much progress. However, order totals are expected to jump in the coming months when all OEMs fill in all the first quarter build slots. The needs of the fleets still greatly outnumber the production capacity of the OEMs under the current restrictions.”

Ake also notes that while the economy has slowed and freight growth is easing, there remains a significant amount of pent-up demand.

“Some fleets have run their trucks well past their planned replacement cycles and desperately need new trucks. The industry has responded well to the supply shortages but will need an increase in production in 2023 to begin to balance out,” he says.