The strategic design and technical R&D to make hydrogen a feasible clean energy option in the U.S. started 20 years ago. Although the development in the last decade seems to be slower than expected, progress in unlocking hydrogen markets has accelerated recently, driven by government policies and incentives.

The U.S. was second in the world for H2 vehicle sales in 2021, but this has been dominated by passenger vehicles and the H2 commercial vehicle market currently lags behind Europe and China.

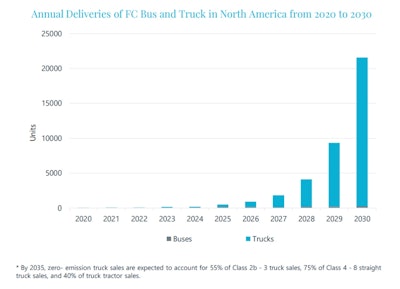

We predict that the full lifetime total cost of ownership (TCO) for buses and heavy-duty long-haul trucks will not be competitive compared with that of battery electric vehicles (BEVs) until 2030. However, our research forecasts that, by 2030, heavy duty trucks will be the most common application of hydrogen in transportation. This is, in large part, because heavy-duty vehicles can be hard to electrify.

H2 fuel cell powertrain technology has some specific advantages that make it a better zero emission alternative to battery-electric solutions in some commercial vehicles. For example, hydrogen can power heavy long-haul vehicles without sacrificing cargo space and payload, and does not come with the long charging times needed for commercial battery electric vehicles (BEVs). There are also significant advantages to decarbonizing heavy-duty transport in terms of reducing dangerous emissions and environmental impact, making hydrogen a viable fuel in the commercial transport sector.

Strong growth forecast for global H2 trucks market

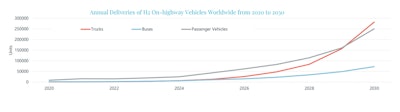

By the end of 2021, the total global tally of H2 on-road vehicles was about 50,000, compared with 1.4 million for the overall vehicle market. We are predicting rapid growth in H2 vehicle sales by 2030, following growth of 75% year-on-year in 2021, and in 2024 we forecast H2 trucks will outsell H2 buses, with heavy trucks showing the strongest growth.

Interact Analysis

Interact Analysis

In the U.S. market, rollout of hydrogen (H2) fuel commercial trucks and vans is reliant on the development of a viable H2 truck and fueling infrastructure. Recent U.S. government support, funding and incentives, coupled with rising global demand for H2 commercial vehicles, are expected to drive growth to more than 20,000 H2 bus and trucks delivered each year by 2030. Interact Analysis

Interact Analysis

Infrastructure essential for U.S. H2 truck and van rollout

Challenges exist in the U.S. H2 commercial trucks and vans sector that must be overcome in order for it to flourish, including high costs over the lifetime of a vehicle and a lack of refueling infrastructure. Hydrogen refueling stations are critical when rollout of trucks scale up, and the fuel cell truck market can only gain commercial momentum when refueling networks are widely available.

There were more than 760 H2 refueling stations worldwide at the end of 2021 and the U.S. was in fifth place globally, with a total of 67 stations. Construction has been relatively slow in the U.S. compared with rates in Asia, but is starting to pick up as demand increases.

U.S. government support to drive commercial fuel cell vehicle demand

The U.S. government is providing great vision for the future of hydrogen trucks, but the hydrogen truck sector is still in its infancy. As early as the beginning of the 21st century, the U.S. government identified H2 as an energy source and has accelerated its support for fuel cell transport and decarbonization of heavy long-haul vehicles in recent years.

The Department of Energy (DOE) outlined the path towards the future of H2 transport and technical targets in its Hydrogen Program Plan, released in 2020. Furthermore, the DOE’s draft National Clean Hydrogen Strategy and Roadmap, published in 2022, provides milestones for H2 supply chain for the near, mid and long-term.

The U.S. government increased financial support to green hydrogen in the Bipartisan Infrastructure Law, signed in November 2021, which includes planned funding worth $9.5 billion for green H2. Investment is already underway to establish H2 hubs and zero emission medium- and heavy-duty vehicle corridors, expand the H2 fueling network for freight transport, and reduce the cost of clear hydrogen. In addition, the Inflation Reduction Act 2022 offers a 10-year tax credit for clear H2 production.

To date, demonstration deployments of H2 commercial vehicles have been government funded. The collaboration between Toyota and Kenworth is the biggest pilot project in the past few years. Ten Class 8 fuel cell trucks were deployed at the Port of Los Angeles and there are new projects involving fuel cell trucks in the pipeline over the coming years.

Schemes include the deployment of 30 fuel cell trucks through the NorCAL project, a cooperation between Hyundai and the Center for Transportation and the Environment (CTE). Funding worth $22 million is being provided by the California Air Resources Board (CARB) and the California Energy Commission (CEC), with the fleet expected to operate for 6 years.

The U.S. is already attracting multiple suppliers of H2 heavy-duty trucks, with Nikola and Quantron also anticipating significant deliveries of H2 heavy-duty trucks this year, and Nikola planning to establish 60 refueling stations by 2026. Furthermore, the DOE is also pledging $127 million over the next 5 years for SuperTrucks3, which will provide funding to manufacturers pioneering electrified medium- and heavy-duty trucks, including H2 vehicles. Companies investing in H2 vehicle development and demonstration include Paccar (18 Class-8 battery-electric and fuel-cell vehicles with advanced batteries), General Motors (4 hydrogen fuel cell Class 4-6 trucks), Daimler (2 Class 8 fuel cell trucks with a 600-mile range), and Ford (5 hydrogen fuel-cell-electric Class 6 Super Duty trucks).

California is expected to continue leading the way in the U.S. The Hydrogen Fuel Cell Partnership based in Sacramento (formerly the California Fuel Cell Partnership) announced that it hopes to help deploy 70,000 heavy-duty trucks by 2035. Advanced Clean Trucks regulation will also drive the H2 heavy-duty truck market in the state.

The long-term outlook for U.S. H2 commercial vehicles is strong

There are many positive signs for the rollout of H2 trucks in the U.S. but more suppliers and heavy-duty refueling stations need to be established. The U.S. government's unprecedented green H2 support policy this year may make it possible to effectively reduce the cost of H2 supply.

Compared with the Chinese and European markets, there are only a small number of H2 commercial vehicle suppliers in the U.S. and more are needed, but the U.S. has a huge amount of non-electrified heavy-duty trucks, opening up considerable potential for H2. If hydrogen can show an unparalleled advantage in the heavy-duty long-haul segment, the technology will be the only option in the future for zero emission trucks.