New construction starts in March advanced 7 percent to a seasonally adjusted annual rate of $521.4 billion, according to McGraw Hill Construction, a division of McGraw Hill Financial.

Nonresidential building picked up the pace after its lackluster performance at the outset of this year, while nonbuilding construction managed a moderate gain.

Meanwhile, residential building settled back as single family housing remained sluggish. During the first three months of 2014, total construction starts on an unadjusted basis were reported at $107.4 billion, down 2 percent from the same period a year ago.

Click to enlarge

Click to enlargeThe latest month’s data lifted the Dodge Index to 110 (2000=100), up from February’s 103, and close to last year’s average reading for the Index at 112.

“The slow start for construction activity in early 2014 can be attributed to tough winter weather conditions, in combination with the up-and-down pattern that’s frequently been present during the hesitant upturn witnessed over the past two years,” says Robert A. Murray, chief economist for McGraw Hill Construction. “This is particularly true for nonresidential building, which bounced back sharply in March after depressed activity in January and February, alleviating some concern that its recovery may be stalling.”

Nonresidential building’s potential for more growth in 2014 is being supported by a rising volume of bank lending directed at commercial real estate development, more energy-related manufacturing projects, and signs that the institutional building sector is finally turning the corner after five years of decline, Murray notes.

At the same time, nonbuilding construction in 2014 is seeing a less severe pullback for electric utilities compared to last year, although public works is generally proceeding at a slower clip.

Residential construction

Residential building so far in 2014 is benefitting from more strength for multifamily housing, yet the loss of momentum for single family housing in the first three months of 2014 stands out relative to the steady gains registered in 2012 and most of 2013, he adds.

Still, there is room for optimism.

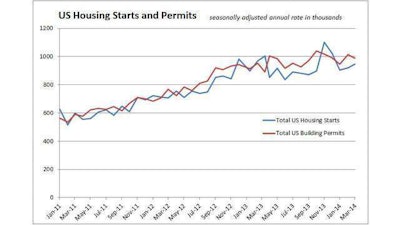

Led by a 6 percent rise in single-family starts, nationwide housing production in March rose 2.8 percent above an upwardly revised February rate of 920,000 to a seasonally adjusted annual rate of 946,000 units, according to newly released figures from HUD and the U.S. Census Bureau.

“We see improving signs of new-home construction as we move into the spring buying season,” says Kevin Kelly, chairman of the National Association of Home Builders and a home builder and developer from Wilmington, Del. “The strongest recovery is in the Northeast and Midwest, where builders were hampered by severe winter weather earlier in the year.”

The March report is in line with the NAHB forecast of a gradual strengthening in the housing sector in 2014, adds NAHB Chief Economist David Crowe.

Regionally in March, combined single- and multifamily housing production rose strongly in the Northeast and Midwest with gains of 30.7 percent and 65.5 percent, respectively, but fell 9.1 percent and 4.5 percent in the South and West, respectively.

Overall permit issuance fell 2.4 percent to 990,000 units in March. The Northeast and Midwest posted gains of 33.3 percent and 26 percent, while the West was unchanged and the South posted a 17.1 percent decline.

Builder confidence

Meanwhile, builder confidence in the market for newly built, single-family homes rose one point to 47 in April from a downwardly revised March reading of 46 on the latest NAHB/Wells Fargo Housing Market Index.

“Builder confidence has been in a holding pattern the past three months,” says Kelly, “Looking ahead, as the spring home buying season gets into full swing and demand increases, builders are expecting sales prospects to improve in the months ahead.”

Low mortgage interest rates and affordable home prices are both positive indicators.

“While these factors point to a gradual improvement in housing demand, headwinds that are holding up a more robust recovery include ongoing tight credit conditions for home buyers and the fact that builders in many markets are facing a limited availability of lots and labor,” Crowe says.

The HMI index gauging current sales conditions in April held steady at 51 while the component gauging traffic of prospective buyers was also unchanged at 32. The component measuring expectations for future sales rose four points to 57.

The HMI three-month moving average was down in all four regions. The West fell nine points to 51 and the Midwest posted a four-point decline to 49 while the Northeast and South each dropped two points to 33 and 47, respectively.

Scores over 50 indicates that more builders view conditions as good than poor.

Regional survey

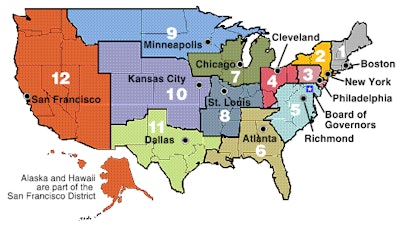

Indeed, reports on residential housing markets varied, according to the most recent Beige Book, a district-by-district survey by the Federal Reserve.

Across most Districts, home prices rose modestly and inventory levels remained low. Residential construction increased in several districts; only Cleveland, St. Louis, and Minneapolis reported a decrease.

Commercial construction also strengthened, again with the exception of Cleveland, which reported a mild decline. Commercial leasing activity generally advanced at a modest pace, according to the report.

Loan demand has strengthened since the previous Beige Book. Credit quality improved in the Philadelphia, Cleveland, Richmond, and Kansas City districts. New York and Dallas reported especially strong increases.

New York, Philadelphia, Cleveland, and Richmond cited the inclement weather as a factor reducing home sales and therefore mortgage borrowing. Commercial loan volumes grew in each of the Districts reporting on banking except St. Louis, where lending declined marginally.

Labor market conditions were mixed but generally positive. The New York, Cleveland, Richmond, Chicago, Kansas City, and Dallas Districts reported difficulty finding skilled workers.