While still mitigating a downturn in new truck sales, Mack Trucks President Dennis Slagle said this week that the first half of 2017 should prove much brighter.

In its most recent quarter report Mack scaled back its forecast for North American production from 250,000 units to 240,000.

“The bottom line is that we had too many trucks come into the pipe line and that needed to be corrected,” Slagle said at a press conference Wednesday in New York.

Some of the factors leading to a decline in truck sales include a lackluster retail market, particularly around Christmas, coupled with a substantial and active used truck market.

However, Slagle said there are positive signs in the market that point to recovery.

“As I said, I am more encouraged lately. We’re seeing full employment. We’re seeing record levels in the stock market, which means that people probably feel that they have some money to spend,” he said.

Consumer spending will once again carry the day, Slagle announced, and clear off the shelves, and generate the need for restocking and additional truck movement.

“In general, we’re all looking at our crystal ball now, but in general we think it will need the rest of this year, but ’17 should at least begin returning to normal, or let’s say looking much more brighter as far as where the industry is.”

In the interim, to help cope with lower than anticipated truck sales, Mack is reducing production for the rest of the year.

“At this stage we feel that we can manage this with just down weeks. So, we are planning down weeks for the back half of the year, rather than line reduction and layoffs,” Slagle said. “So, at this point we’ll always react to what the market dictates, but at this point we feel pretty good that we’ll maintain the line rate which is important because we don’t have to retrain everybody at a different job, and we’ll manage it through down weeks.”

Mack is also concerned about sluggish manufacturing and the strength of the U.S. dollar.

“We like manufacturing in this country because you’re taking goods to the factory and pulling them out, rather than just from the dock to the location,” Slagle said. “So, we’ll keep an eye on manufacturing levels, the strength of the dollar and those other dynamics as well.”

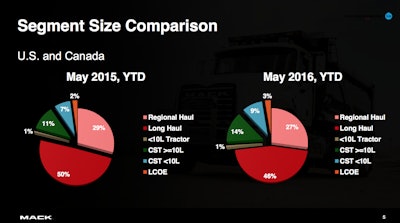

Certain market segments have helped carry the load of a lagging freight sector.

“Mack had a good quarter of market share. We’ve had another good quarter. Some of that tail wind is from the fact that most of the bubble correction, or whatever, has been around highway and the vocational straight truck business is holding up better,” Slagle said.

“So we get a natural sort of mixed benefit, but it’s also down to some of the things we’ve done feature wise with products. The mDRIVE is just going nuts. I mean people love it.

“This is a fantastic product and I don’t have to tell you between mDRIVE and I-Shift (Volvo Trucks), I think we’ve changed the industry, or led the change in the industry to AMTs. And that just continues. It’s a great product. We’re really happy.”

Mack is optimistic about new construction, thanks in large part to low interest loans.

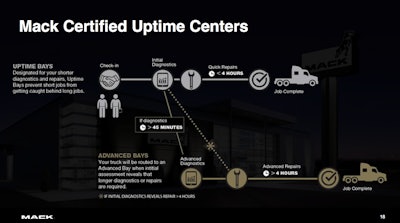

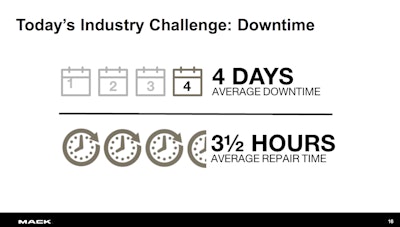

Given the increased complexity of proprietary technology, Mack is setting its sights on expanding its service centers, while being mindful of reducing downtime for its customers.

John Walsh, Mack’s vice-president of marketing, who also talked with reporters, revealed some impressive service gains at Mack dealerships over the last four years, such as a 40 percent increase in service bays and a 250 percent increase in the amount of certified master technicians.

An average four-day service downtime has been cut in half, Walsh said, along with an increase in shop efficiency by 8 percent and an increase in repair orders closed by 21 percent.

The Mack Certified Uptime Center program, which began earlier this year, requires Mack dealers to meet certain service requirements. Thirty-nine service centers have been certified to date, while 60 are expected to receive certification by the end of the year. Mack’s long-term goal is to certify all 430 of its service centers.

Mack will invest $70 million in its Lehigh Valley Operations over the next three years which will lead to insourcing of chassis pre-assembly work; a 75,000 square-foot expansion for improved material handling; optimized material flow; a new process for IT systems; updated equipment and tooling; and a new building for quality audits.

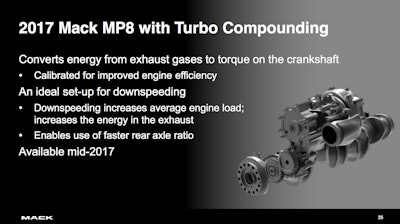

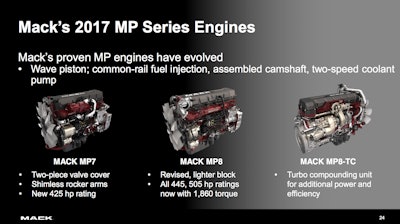

Roy Horton, Mack director of product strategy, told reporters that a Mack MP8 engine with turbo compounding will be available in mid-2017. See the slides below for more information on it and other 2017 MP series engines.