Buying the right pickup entails thinking about a lot of factors. But how many discussions revolve around a new truck’s insurance rates? Not many.

Besides fuel and maintenance costs, truck insurance is another ongoing expense that, after a few years, can easily run into thousands of dollars.

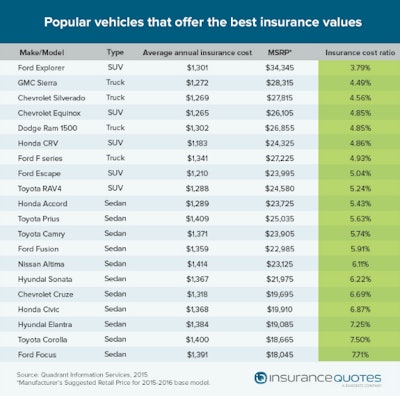

The good news, according to insurancequotes.com, is that trucks and SUVs offer the best overall insurance rates in the country.

As anyone might suspect, this comparative study on 20 popular U.S. vehicles points out that since trucks and SUVs offer better personal protection in a collision and sustain less vehicle damage, they’re cheaper to insure. Less risk equals a better rate.

The most expensive cars to insure, on average, are compact cars. The chances of bodily harm and car damage are greater following a collision. No surprise there. In fact, only one sedan made the top-ten.

Small cars, such as the Ford Focus, are the most affordable among new cars and more often attract younger buyers who don’t always think about a car’s increased insurance rate and, more importantly, why that rate is higher in the first place.

Of course there are other factors that effect insurance rates: the area where the vehicle will be primarily driven, it’s value, it’s theft rate, and of course, the primary driver. The reports states that truck and SUV owners are typically older and more responsible, which also helps to keep their rates down.

The Quadrant Information Services study, based on 2015-2016 base models, uses an insurance-to-cost ratio to determine the best deals. For instance, the MSRP on a Ford Focus is $18,045, but on average it costs nearly $1,400 annually to insure. Its insurance cost ratio of 7.71 percent is the worst of the 20 vehicles studied.

By comparison, a Ford Explorer with an MSRP of $34,345 and an average annual insurance rate of $1,301 has the best insurance cost ratio at 3.79 percent.